Managing risk on energy and oil projects in Asia and Latin America

16th October 2025

The risks facing major engineering and construction projects are as complex as they are varied – spanning global supply chains, regional market conditions, cultural differences among delivery partners, and even the site’s geological conditions.

Given this diversity, it should be no surprise that claims and disputes display persistent patterns across borders while also varying between regions and sectors. This is especially true for energy and oil projects in Asia and Latin America, which are the focus of this article.

Our integrated research program, CRUX, analyzes claims and disputes on capital projects worldwide that have been investigated firsthand by experts. This analysis identifies the underlying causes of conflicts and quantifies the impact on schedules and budgets. The insights gained can be used by clients and the wider industry to help mitigate risks and achieve better outcomes.

The global view

For our Seventh Annual CRUX Insight report,[1]HKA Global Limited, Seventh Annual CRUX Insight report, 2024 we analyzed more than 2,000 projects across 107 countries over seven years. Many were megaprojects, with an average capital expenditure (Capex) value of US$1.28 billion and a combined value of over $2.25 trillion.

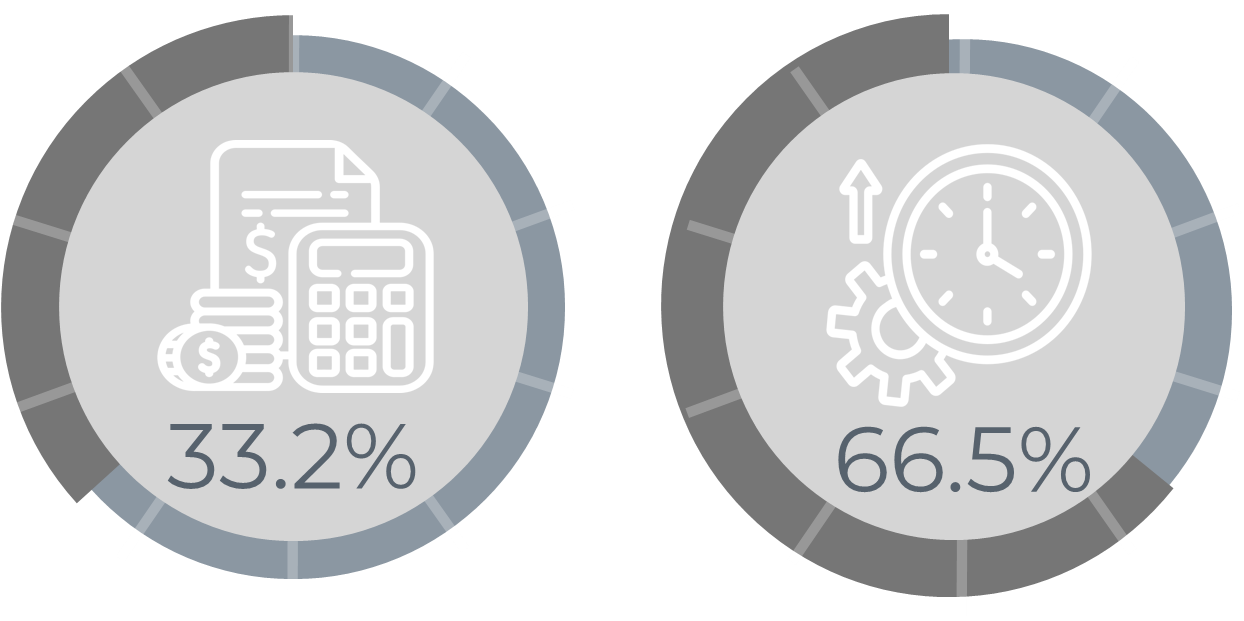

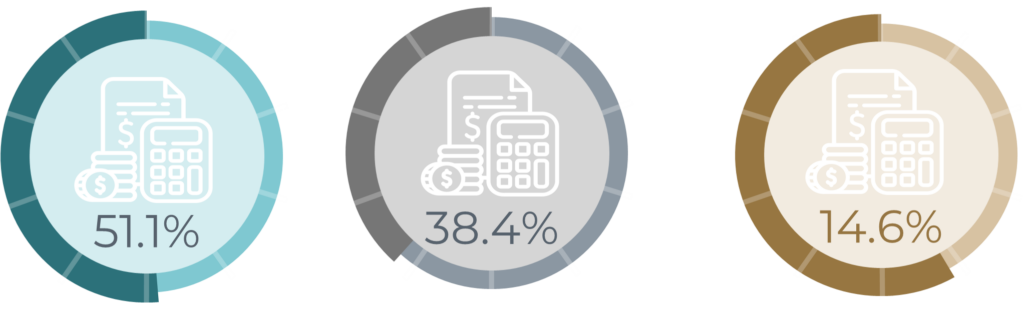

CRUX shows the heavy price distressed projects pay for conflict. Sums in dispute amounted to $84.4 billion, while additional costs claimed averaged one-third (33.2%) of contracts’ budgeted Capex. The loss of time was even more severe. Overruns reached nearly two-thirds (66.5%) of planned schedules, averaging around 16 months.

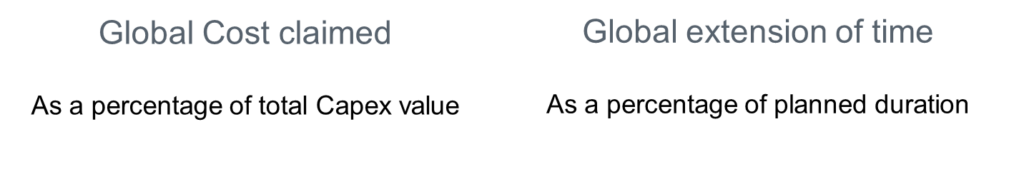

Change in scope was the top cause of claims and disputes in almost all regions and sectors – affecting 36.9% of projects. CRUX also confirmed the massive damage done by three design-related failings, each affecting around one-fifth of projects: incorrect design (21.5%), late design information (21.3%), and incomplete design (19.8%).

Combined, this cluster of design-related causes impacted nearly half of all projects (47.6%). Across sectors and the world, this design “mega-disrupter” is driven by the imperative to speed the build. Clients and contractors strive to save time and money up front, often losing both later as design and other shortcomings impede progress over the project’s life. (Other mega-disrupters – involving behavioral, environmental, skill, and contractual factors – are also examined in the CRUX Insight report.)

Global energy disruption

More recently, the global energy industry has faced greater change and disruption than most sectors. The falling cost of renewables and national efforts to decarbonize electrical grids pose huge challenges and opportunities as energy demand rises in both developing and developed countries.

The aftershocks of Russia’s war in Ukraine have further complicated the planning and delivery of energy projects – from short-term energy insecurity and fluctuating oil and gas prices to rapid cost inflation and supply chain bottlenecks. Relatively rapid change in the scale and componentry of clean energy technology also stretches the capabilities of contractors, especially those moving into the renewables sector.

Of the 2,002 capital projects analyzed in CRUX, almost 30% involved energy in the form of power and utility projects (including solar and wind) or the extraction and/or processing of natural resources (excluding mining and metals) – namely, oil and gas (including LNG). For these 587 projects, claimed extensions of time tended to be somewhat lower than the global average for all sectors – at 61.3% of planned schedules (versus 66.5% for all project types). But costs in dispute were higher, at 38.1% of contract budgets (versus 33.2%).

Asia’s energy surge

Asia was heavily represented with 60 projects across 15 countries, reflecting the current surge in energy investment on the continent. The massive scale of many megaprojects was also notable. The average Capex value of almost $9.3 billion was over three times the global average.

Despite their engineering and construction complexity, these projects’ outcomes compared favorably with those of other regions overall. Extension of time claims in Asia were found to be slightly below the global average (61.3%). Nevertheless, the extra time sought by contractors to complete contracts would prolong planned schedules by 59.6% – a significant opportunity cost to owners in lost operating income.

The energy and power sector across Asia performed much more effectively in cost control than other regions. Sums in dispute were restricted to 14.6% of budgeted Capex on average. This was less than one-third of the typical toll on equivalent projects worldwide (38.1% of budgeted Capex). Cultural factors partly explain the gap in financial performance compared with the rest of the world, as Asian countries’ more claims-averse approach leads parties to resolve disagreements without invoking formal dispute procedures.

Latin American losses

The contrast with Latin America is stark. CRUX analyzed 25 energy and power projects across eight countries in this region. With a typical contract Capex of just over $420 million, they were far smaller in scale than their Asian counterparts but suffered disproportionate overruns.

The extensions of time claimed would extend programs by 79.1% on average. Compared with other world regions, only energy and power projects in Australasia and Africa endured longer schedule overruns (90.0% and 93.6%, respectively).

Distressed projects in Latin America also incurred far heavier cost claims. These typically exceeded half budgeted Capex (51.1%) – a worse outcome than in any other region and significantly higher than the global 38.4% average for these types of projects.

Variations in underlying causes

While the causes of claims and disputes across all infrastructure and capital projects are highly consistent worldwide, CRUX also reveals some sharp regional and sectoral variations.

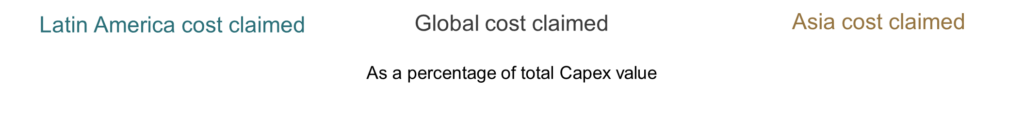

Change in scope remains the most prevalent feature of distressed engineering and construction projects. Energy, power, and utility projects followed this pattern. In Asia, scope change drove disputes on 40.0% of the CRUX subset of energy-related projects. Reflecting the scale of these megaprojects, this impact was greater than the global average for these sectors (36.6%).

For most of the other main factors underlying claims and disputes, Asia was on a par with or lower than the global benchmarks. The main exception (apart from scope change) was operational performance, which gave rise to conflicts on 16.7% of energy and power projects (versus 12.8% globally). Mismanagement of subcontractors or suppliers was only slightly more prevalent (18.3% in Asia vs. 17.7% globally).

Disputes in Latin America, affecting 28.0% of all global energy, power, and utility projects, were less likely than those in Asia to be blamed on changes in scope. Failures in contract management afflicted the same proportion of projects as scope change – more than worldwide (19.8%) and in Asia (16.7%).

Restricted access to sites or workfaces also triggered more disputes than elsewhere. Almost one-quarter (24.0%) of Latin American projects were affected, compared with around 20% both globally and across Asia.

Supply chain disruption in Latin America, resulting in late deliveries of materials or products, impacted one in five projects – far higher than in Asia (8.3%) and worldwide (14.7%). Other underlying causes of project conflict showed a more consistent pattern with other regions.

Rising risks in energy and natural resources

It is notable that, in both regions and worldwide, the oil and gas sector was more susceptible to certain sources of conflict.

The impact of change in scope was considerably higher, for example. Globally, the proportion of energy and natural resources projects disrupted by this factor rose to 46.0% of just over 250 projects. This was a rise of around 10 points from the 36.6% of all 580-plus energy and power projects worldwide that experienced claims and disputes due to scope change.

In Asia, that share rose even more sharply to 57.5% (from 40.0% of all energy-related projects in the region). Meanwhile, in Latin America, it increased to 36.4% from its lower base (28.0%).

Other drivers of claims and disputes were also more common on energy projects than across energy, power, and utility projects as a whole.

In Asia, where 40 of the projects analyzed involved energy resources, design failures triggered more disputes:

- Late design information affected 25.0% of projects.

- Design errors gave rise to conflict on 20.0%.

- Incomplete designs disrupted 17.5%.

In Latin America, claimed extensions of time stretched to 87.2% of planned schedules for this smaller sample of around a dozen projects. Several factors contributed to the industry’s worst record for schedule overruns:

- Late design information was the top cause of disputes, affecting 45.5% of oil and gas projects.

- Late deliveries of materials or products almost doubled to 36.4%.

- Four other factors each affected more than one-quarter (around 27%) of projects – late approvals, conflicts over cashflow and payments, contract interpretation issues, and failures in contract management.

These are just some of the notable variations in the levels and types of claims and disputes revealed by CRUX. By recognizing the recurrence of certain factors and the heightened risk in particular regions or sectors, this knowledge can be used to mitigate those risks more effectively and achieve better project outcomes.

About the author

Tim Chitester is a Partner at HKA and a registered professional engineer with over 45 years of experience in the engineering, design, and construction industries. He is an authority in the resolution of construction disputes, construction claims, project management, and property loss and business interruption claims. Tim has been appointed as a delay, quantum, or technical expert on more than 100 occasions.

This article presents the views, thoughts, or opinions only of the author and not those of any HKA entity. The information in this article is provided for general informational purposes only. While we take reasonable care at the time of publication to confirm the accuracy of the information presented, the content is not intended to deal with all aspects of the referenced subject matter, should not be relied upon as the basis for business decisions, and does not constitute legal or professional advice of any kind. HKA Global, LLC is not responsible for any errors, omissions, or results obtained from the use of the information within this article. This article is protected by copyright © 2025 HKA Global, LLC. All rights reserved.

References

| ↑1 | HKA Global Limited, Seventh Annual CRUX Insight report, 2024 |

|---|