Can a contract price be paid in Bitcoin?

10th June 2024

One of the cornerstone principles in contract law is consideration. For a contract to be valid, there must be an exchange of value between the parties involved to ensure that each party has a stake in the agreement, thereby creating a binding commitment. The value exchanged doesn’t need to be equal, but it must be something of value to the parties involved.

Under the common law, and as explained by Justice Lush in Currie v Misa[1](1875) LR 10 Ex 153. at paragraph 162, “[a] valuable consideration, in the sense of the law, may consist either in some right, interest, profit or benefit accruing to the one party or some forbearance, detriment, loss or responsibility, given, suffered or undertaken by the other.”

As such, a consideration under a contract should have (i) a real economic value and (ii) a legal value, otherwise it would fail to be construed as valid.

Bitcoin in construction contracts

In construction contracts, the consideration commonly takes the form of money paid in a currency that is specified under the contract. For instance, Sub-Clause 14.15 [Currencies of Payment] of FIDIC Red Book 2017 stipulates that “[the] Contract Price shall be paid in the currency or currencies named in the Contract Data.”

However, given the recent shift from physical banknotes (or coins) towards digital payment solutions, interest in digital currencies such as cryptocurrencies has been growing with the most popular being Bitcoin (aka “BTC”).

Notwithstanding the limited usage of digital currencies, one would wonder whether a construction contract price can be paid through Bitcoins instead of the common fiat[2]Fiat currency refers to the traditional forms of currencies such as the US dollars, Euros, Yen, etc. currencies (e.g., Dollar, Euro, Yen, etc.).

To determine if Bitcoin can be construed as a valid consideration in construction contracts, it is essential to explore whether Bitcoin carries (i) a real economic value and (ii) a legal value.

Real economic value of Bitcoin

The real economic value of Bitcoin, like any other commodity[3]The Commodity Futures Trading Commission (CFTC) classifies some cryptocurrencies (e.g., Bitcoin and Ethereum) as commodities. is invoked by the exchange rate at which you can purchase a Bitcoin i.e., the supply and demand relationship. For instance, in early March 2024[4]Chris Price, ‘Bitcoin hits $70,000 in new record high’ (Yahoo Finance, 8 March 2024)., the price of 1.00 BTC reached around USD 70,000.00 implying that there is a consensus amongst buyers and sellers to fulfill a transaction (i.e., transferring the ownership of 1.00 BTC) for that price.

Such consensus is induced by, inter alia, the idea of considering Bitcoin as an asset that has an underlying value. The World Economic Forum published an article on 4 November 2022 noting that “Cryptocurrencies represent novel payment instruments and infrastructures that aim to form a new rail to existing payment systems. They add to the continuation of money and may complement or substitute existing money. Cryptocurrencies also form part of diversification in asset holdings and potentially in payments”[5]World Economic Forum, ‘Understanding the macroeconomic impact of cryptocurrency and stablecoin economics’ (4 November 2022). (underline added for emphasis).

More importantly, what gives Bitcoin real value is that people take it in trade, keep it as wealth, and measure it in prices. One can witness the upward trend of merchants accepting payments in BTC, particularly for virtual goods and services.

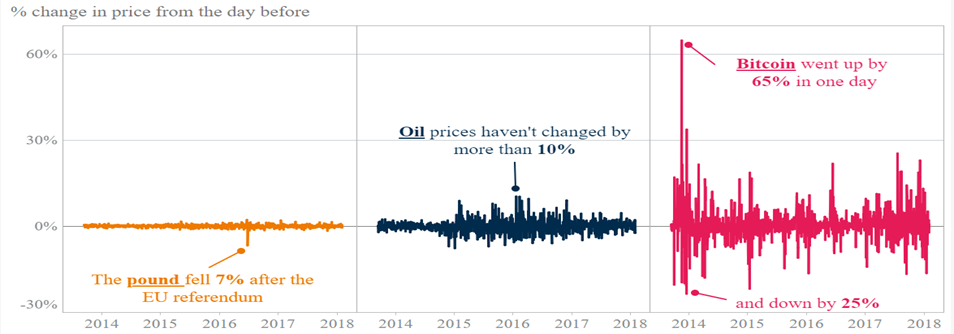

However, Bitcoin’s real economic value is still controversial as some still consider that its high volatility raises concerns about its reliability as a store of value. On 19 May 2020, the Bank of England provided a comparison between the change to the price of (i) Pound, (ii) Oil and (iii) Bitcoin from 2014 up to 2018 and concluded the following graph:[6]Bank of England, ‘What are cryptoassets (cryptocurrencies)?’ (19 May 2020).

The same concern was raised by Vanguard Group – a renowned American investment advisor – which published an article on 20 September 2021 noting that “[the] volatility makes cryptocurrencies impractical as a medium of exchange, and the sudden price movements can encourage impulsive buying and selling. Additionally, these market conditions can make it difficult to liquidate a position in a timely manner, making liquidity risk a real concern.”[7]Vanguard Group, ‘Cryptocurrencies and Vanguard: What we think’ (20 September 2021).

As such, and from a contractual point of view relating to Bitcoin’s economic value, one might consider that such volatility can significantly affect the value of the consideration, potentially undermining the fairness and balance of the contract.

Legal value of Cryptocurrency

In general, and as noted above, payments under a construction contract are made via a specific currency, which is acknowledged by the contract’s governing law as a legal tender.

Legal tender can be defined as “anything recognised by law as a means to settle a public or private debt or meet a financial obligation, including tax payments, contracts, and legal fines or damages.”[8]Charles Potters, ‘Legal Tender: Definition, Economic Functions, Examples’ (Investopedia, 13 June 2021).

For example, the governing law of a country acknowledging a currency as a legal tender is the Government Tenders and Procurement (“GTPL”) of the Kingdom of Saudi Arabia, which provides under Article 64 of Chapter 3 [Payments] that “the value of contracts shall be paid in Saudi Riyals. A government agency may designate other currencies in the tender documents, subject to the Ministry’s prior approval.”

So far, only two counties have recognised by law Bitcoin as a legal tender. In June 2021, El Salvador enacted the Bitcoin Law which stipulates under Article 7 that “[e]very economic agent must accept bitcoin as payment when offered to him by whoever acquires a good or service.”[9]Nelson Renteria, Tom Wilson, and Karin Strohecker, ‘In a world first, El Salvador makes bitcoin legal tender’ (Reuters, 10 June 2021); Roy Avik, ‘El Salvador’s Bitcoin Law: Full English … Continue reading In April 2022, the Central African Republic followed the same path.[10]Jean Fernand Koena, ‘Central African Republic becomes world’s second country to adopt bitcoin as official currency’ (USA Today, 28 April 2022).

Notwithstanding that most countries have yet to recognise Bitcoin as a legal tender, conducting transactions via Bitcoin is not considered illegal, and, therefore, its use should not invalidate the contract. This nevertheless depends on the law governing the contract.

For instance, the UAE courts invalidated a cryptocurrency sale contract and held that “Bitcoin is a digital currency that does not meet the legal and Sharia criteria that make it a currency subject to the rulings of dealing with official legal currencies recognised internationally […] Therefore, it is not permissible to deal with Bitcoin or other electronic currencies that do not meet the recognised Sharia and legal criteria …”[11]Mahmoud Abuwasel, ‘Shariah rules and crypto disputes: UAE court judgment and official Fatwa invalidate cryptocurrency transaction’ (Wasel & Wasel, 4 Mary 2023).

However, the UAE courts concluded that “if a decision is made to regulate and adopt [Bitcoin] and place [Bitcoin] under a supervisory umbrella by those authorities, so that they meet the criteria that make them a legal currency, used in transactions between countries, then the ruling on dealing with [Bitcoin] would take the same ruling as dealing with officially recognised currencies.”[12]Ibid.

Can a contract price be paid in Bitcoin: The answer

Undeniably, the answer to the question of whether a contract price can be paid by Bitcoin remains enveloped in a shroud of uncertainty from technical, economic, and legal perspectives. Therefore, it is advisable to wait and see how the law develops on these matters.

About the Author

Hadi Lakkis is a Managing Consultant based in HKA’s Abu Dhabi office. A civil engineer with over twelve years of experience in the construction industry, Hadi holds an MBA, is a Fellow at CIArb, and is currently undertaking an LLM. With extensive and diverse contract administration expertise, mainly in preparing claims, conducting forensic delay analysis, providing contractual advice, and leading amicable settlement negotiations, Hadi has extensive expertise in drafting, interpreting, and applying commercial terms in contracts.

References

| ↑1 | (1875) LR 10 Ex 153. |

|---|---|

| ↑2 | Fiat currency refers to the traditional forms of currencies such as the US dollars, Euros, Yen, etc. |

| ↑3 | The Commodity Futures Trading Commission (CFTC) classifies some cryptocurrencies (e.g., Bitcoin and Ethereum) as commodities. |

| ↑4 | Chris Price, ‘Bitcoin hits $70,000 in new record high’ (Yahoo Finance, 8 March 2024). |

| ↑5 | World Economic Forum, ‘Understanding the macroeconomic impact of cryptocurrency and stablecoin economics’ (4 November 2022). |

| ↑6 | Bank of England, ‘What are cryptoassets (cryptocurrencies)?’ (19 May 2020). |

| ↑7 | Vanguard Group, ‘Cryptocurrencies and Vanguard: What we think’ (20 September 2021). |

| ↑8 | Charles Potters, ‘Legal Tender: Definition, Economic Functions, Examples’ (Investopedia, 13 June 2021). |

| ↑9 | Nelson Renteria, Tom Wilson, and Karin Strohecker, ‘In a world first, El Salvador makes bitcoin legal tender’ (Reuters, 10 June 2021); Roy Avik, ‘El Salvador’s Bitcoin Law: Full English Text’ (FREOPP, 9 June 2021). |

| ↑10 | Jean Fernand Koena, ‘Central African Republic becomes world’s second country to adopt bitcoin as official currency’ (USA Today, 28 April 2022). |

| ↑11 | Mahmoud Abuwasel, ‘Shariah rules and crypto disputes: UAE court judgment and official Fatwa invalidate cryptocurrency transaction’ (Wasel & Wasel, 4 Mary 2023). |

| ↑12 | Ibid. |

This publication presents the views, thoughts or opinions of the author and not necessarily those of HKA. Whilst we take every care to ensure the accuracy of this information at the time of publication, the content is not intended to deal with all aspects of the subject referred to, should not be relied upon and does not constitute advice of any kind. This publication is protected by copyright © 2024 HKA Global Ltd.