Following the Money: Forensic Accounting Tracing Methods & Best Practices

13th March 2024

Most accountants are familiar with the first in, first out (FIFO) and last in, first out (LIFO) inventory pricing methodologies. These are also two of the most common tracing methods for forensic accounting, among other methods such as the lowest intermediate balance rule (LIBR) and pro rata method. With various viable options, how do you know which approach is best for tracing ill-gotten gains?

I worked on a recent case where our team at HKA Global, LLC, was brought in to re-analyze an opposing expert witness’ tracing of alleged fraudulent funds that were comingled with legal funds. To determine which tracing method would be most appropriate for this situation, I looked to the American Institute of Certified Public Accountants (AICPA) and the Association of Certified Fraud Examiners (ACFE) for guidance. To my surprise, neither organization had specific best practices for determining the appropriate accounting method for asset tracing in a given set of facts. This begs the question: Is there one tried and true method for tracing commingled funds?

The short answer is that no specific accounting method can be the preferred methodology in all situations. In cases where the government seizes and moves to forfeit illicit funds, the proper method to present to a trier of fact is often the accounting method that consistently produces the most conservative tracing of the illicit funds. In other civil litigation, the forensic accountant will look to the facts and circumstances of the case at hand to determine which tracing method to use.

What the Courts Say

Despite a lack of guidance from the most commonly referenced accounting scripture, court decisions have been made that help shed some light on this issue. As an example, there is precedent for using the LIBR method, which preserves commingled funds for the benefit of defrauded victims by tracing fraudulent funds only when the balance of clean funds is exhausted.

This precedent dates back to the landmark 1924 case involving the infamous Charles Ponzi. When Ponzi’s scheme was made public, certain investors believed the return on their investments should have been prioritized as they had canceled their contracts with Ponzi. The district and appeals court ruled in their favor.[1]

Another example is the 1986 case of United States v. Banco Cafetero Panama,[2] in which an appeal from the U.S. District Court for the Southern District of New York centered around the government’s attempt to forfeit approximately $3 million as proceeds traceable to narcotics transactions.[3] Although this was also referred to as the Drugs In, Last Out rule (seriously), the court stated that the LIBR method had been used to determine the rights of trust beneficiaries to a trustee’s bank account.

“[T]he ultimate goal is to consistently and equitably apply a tracing method that is most appropriate for the underlying facts of the case.”

The Banco Cafetero court also considered the pro rata method, where the ratio of clean and illicit funds determines the breakdown of clean and illicit withdrawals. However, it determined that LIBR was an appropriate methodology for tracing commingled assets based on the facts presented in the litigation.

Given that the argument can be made for applying different tracing methods in different cases, such as bankruptcy or forfeiture, the tracing exercise itself can serve as an equitable substitute for the impossibility of specifically designating withdrawals attributable to illicit funding.[4] Put succinctly, if the chosen method of tracing is performed on a fair, consistent basis, the chosen method will generally be recognized as having merit.

Tracing Methodologies

When choosing a tracing method, a forensic accountant must consider each methodology and render an opinion based on objective expertise, experience, and the facts that support their decision.[5] The most common tracing methods are explained and illustrated below.

First In, First Out (FIFO)

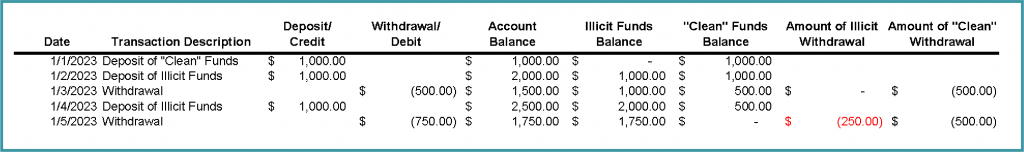

The FIFO method operates under the assumption that withdrawals from a bank account are traceable to the earliest funds that were deposited into the account (shown in Figure 1).

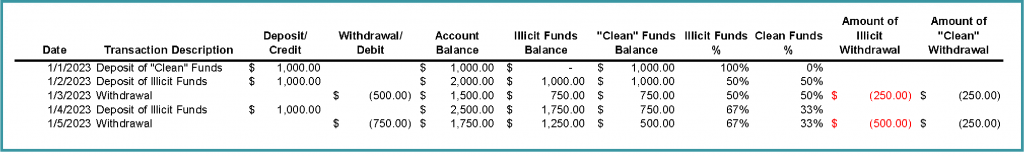

Figure 1: FIFO Tracing of $1,250 in Withdrawals

FIFO Result: $250 withdrawn from illicit funds

For example, let’s say that on January 1, 2023, $1,000 of clean funds is deposited into a bank account. Then, on January 2, 2023, $1,000 of funds obtained from an illicit source is deposited, bringing the account balance to $2,000. Next, on January 3, 2023, a $500 withdrawal is made from the account. Since the clean funds were deposited first, the $500 withdrawal made on January 3, 2023 is traceable to the initial $1,000 deposit made on January 1, 2023 and thus not traceable to illicit funds.

Let’s look at a slightly more complicated situation. On January 4, 2023, another $1,000 of illicit funds is deposited into the account, and then on January 5, 2023, $750 is withdrawn. In this situation, even though there was a larger balance of illicit funds than clean funds in the account at the time of the January 5, 2023 withdrawal, $500 of the $750 withdrawal is attributable to clean funds. Until all the funds from the initial $1,000 deposit of clean money are spent, none of the withdrawals made from the account are deemed as transactions using illicit funds.

Last In, First Out (LIFO)

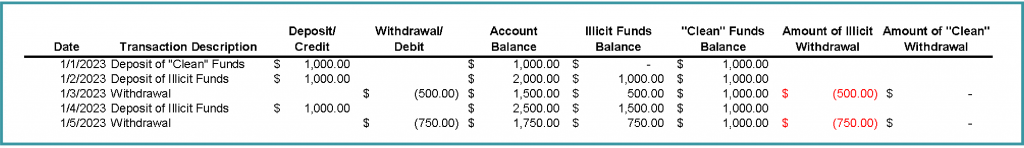

The LIFO method operates under the assumption that withdrawals from a bank account are traceable to the most recent funds that were deposited into the account (shown in Figure 2).

Figure 2: LIFO Tracing of $1,250 in Withdrawals

LIFO Result: $1,250 withdrawn from illicit funds

Let’s assume the same fact pattern in the FIFO example. On January 1, 2023, $1,000 of clean funds is deposited into a bank account. On January 2, 2023, $1,000 of funds obtained from an illicit source is deposited. On January 3, 2023, a $500 withdrawal is made from the account. On January 4, 2023, another $1,000 of illicit funds is deposited into the account. On January 5, 2023, $750 is withdrawn.

Let’s analyze the first withdrawal of $500 on January 3, 2023. Since the $1,000 of illicit funds deposited on January 2, 2023 was the most recent deposit before the withdrawal was made, the $500 withdrawal is associated with the $1,000 of illicit funds, not the initial $1,000 deposit of clean funds.

Likewise, the withdrawal of $750 on January 5, 2023, would be deemed illicit, given that the $1,000 of illicit funds deposited on January 4, 2023, was the most recent deposit before the $750 withdrawal was made.

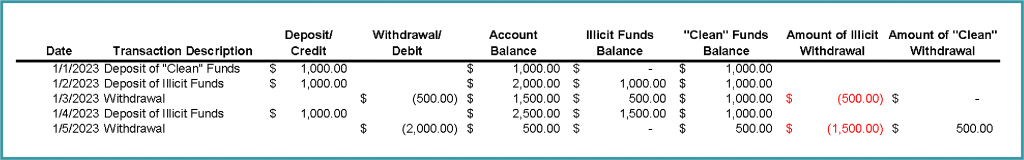

Now, let’s change the facts slightly (see Figure 3). Suppose the withdrawal made on January 5, 2023 is now in the amount of $2,000 instead of $750. The most recent funds that have not already been traced are the $1,000 illicit deposit made on January 4, 2023, $500 of the $1,000 illicit deposit made on January 2, 2023, and all $1,000 of the clean deposit made on January 1, 2023. Remember that $500 of the illicit deposit made on January 2, 2023 was accounted for in the $500 withdrawal on January 3, 2023.

Figure 3: LIFO Tracing of $2,500 in Withdrawals

LIFO Result: $2,000 withdrawn from illicit funds

Because the LIFO methodology tells us to trace the most recent funding first, we would first trace the $1,000 illicit deposit on January 4, 2023 and then trace the remaining $500 of the illicit deposit from January 2, 2023, bringing the total withdrawal of illicit funds to $1,500. The remaining $500 of the $2,000 withdrawal would then be traced to the next most recent deposit, which is the January 1, 2023 clean deposit. This would leave $500 in untraced clean funds in the account, with all the illicit funds withdrawn.

Lowest Intermediate Balance Rule (LIBR)

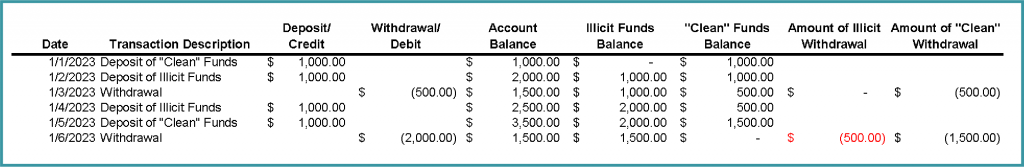

LIBR, one of the lesser-known tracing methods, operates under the assumption that the owner of a commingled bank account that has both clean and illicit funds will preserve the fraudulently obtained money for the benefit of the defrauded victims (shown in Figure 4).[6] Consequently, the illicit funds are only used for tracing when the balance of the clean funds is reduced to zero.

Figure 4: LIBR Tracing of $2,500 in Withdrawals

LIBR Result: $500 withdrawn from illicit funds

Let’s assume the same fact pattern as in our FIFO and LIFO examples, except the withdrawal of $2,000 now occurs on January 6, 2023 and an additional $1,000 of clean funds was deposited on January 5, 2023.

First, let’s trace the $500 withdrawal made on January 3, 2023. Since the balance in the commingled account contains $1,000 of clean funds, the LIBR method deems the $500 withdrawal as traceable to clean funds, reducing the balance of clean funds to $500.

Next, let’s trace the $2,000 withdrawal made on January 6, 2023. At the time of the withdrawal, the balance of clean funds in the account is $1,500. Under LIBR, illicit funds are only used when the balance of clean funds is $0. Thus, $1,500 of the withdrawal is associated with clean funds, and the remaining $500 is traced using illicit funding.

Pro Rata

Under the pro rata method, when analyzing a commingled bank account, the running balance of clean versus illicit funding into the account determines how much of the withdrawal is allocable to clean and/or illicit funds (shown in Figure 5).

Figure 5: Pro Rata Tracing of $1,250 in Withdrawals

Pro Rata Result: $750 withdrawn from illicit funds

Let’s go back to our original fact pattern used in the LIFO and FIFO examples.First, when tracing the $500 withdrawal made on January 3, 2023, we need to understand the distribution of clean versus illicit deposits made into the account at the time of the withdrawal. Since $1,000 was deposited from clean funding and $1,000 was deposited from illicit sourcing, 50% is allocated to both clean and illicit funding at the time of the withdrawal. As such, $250 is withdrawn using illicit funding, and $250 is withdrawn using clean funding.

However, for the withdrawal made on January 5, 2023, the percentages differ due to the January 4, 2023 deposit of $1,000 in illicit funds. At the time of withdrawal on January 5, 2023, there is a total of $2,000 in deposits of illicit funds and $1,000 in deposits of clean funds, meaning illicit funds account for 67% of the deposits while clean funds account for 33%. As such, when tracing the $750 withdrawal made on January 5, 2023, $500 (67%) is applicable to illicit funding, while $250 (33%) is applicable to clean funding.

It is important to keep in mind that the pro rata percentages used to determine how much of a withdrawal is applicable to clean and/or illicit funds are only ever changed when a deposit is made to the account.

Different Methods, Different Results, Different Applications

As you can see, different tracing methods yield different results. Let’s compare the total amounts withdrawn under both scenarios presented.

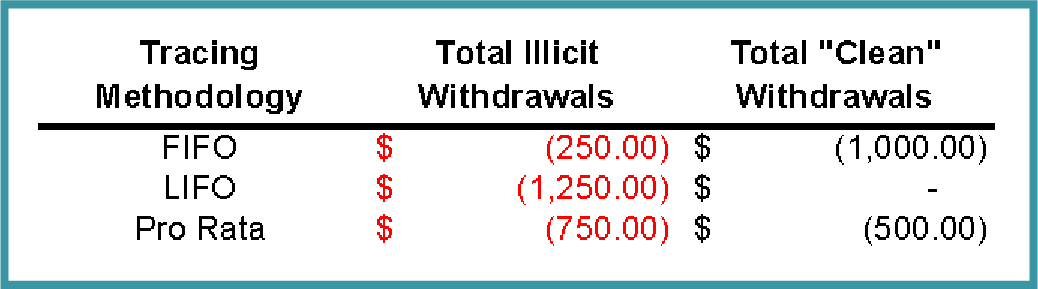

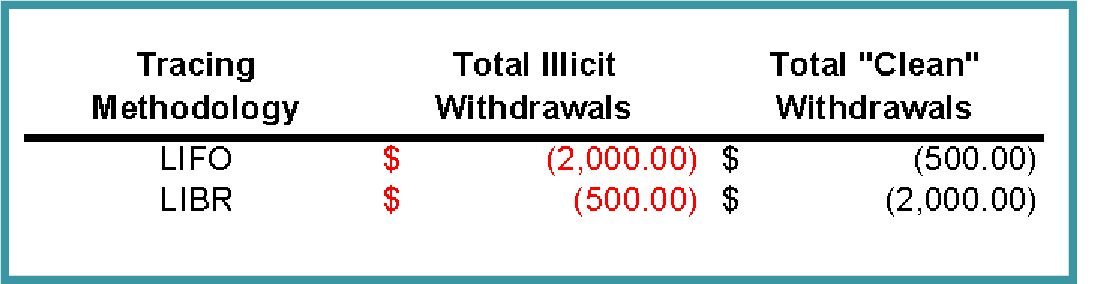

When analyzing the results, it is prudent to apply the most consistent method that most accurately traces illicit and clean funds. For example, if a forensic accountant was engaged by a defendant who was being accused of spending illicit funds, they may be inclined to use the FIFO method (shown in Figure 6a) or the LIBR method (shown in Figure 6b) as these methods result in the lowest amounts of illicit withdrawals. However, selecting the method that is best for the client may not be the most appropriate method to use for tracing if the facts of the case and the patterns in which withdrawals were being made give more defensibility to a different method.

Figure 6a: Tracing Results with $1,250 Withdrawn

Figure 6b: Tracing Results with $2,500 Withdrawn

When governmental entities such as the Federal Bureau of Investigation (FBI), the Department of Justice (DOJ), and the Internal Revenue Service Criminal Investigation (IRS:CI) attempt to trace and forfeit specific illicit funds that are commingled, they are trained to use the most conservative applied methodology that produces the lowest amount of funds traceable to illicit sources.

With that in mind, in the second example shown in Figure 6b, the government might choose the LIBR method. But let’s say the account holder had a habit of making a withdrawal immediately after depositing the illicit funds as part of their scheme. This is a common practice in forensic accounting fraud cases. Although the LIFO method would better represent the facts of the case, the government would likely still choose the LIBR method for the tracing exercise as it results in the lowest amount of funds traceable to illicit sources.

A Real-Life Example

In June 2023, I was managing a case, United States v. Shah,[7]which involved the government seizing a number of assets from an individual who allegedly used illicit funds to purchase them. HKA was engaged to analyze the government’s tracing schedules and provide opinions on whether any of the assets should not be subject to forfeiture by tracing several of the defendant’s bank accounts using the FIFO, LIFO, and pro rata methods.

“[T]he tracing exercise itself can serve as an equitable substitute for the impossibility of specifically designating withdrawals attributable to illicit funding.”

In the most recent court ruling, the government acknowledged that nearly $5 million in Shah’s assets, which were restrained previously, were not traceable to illicit funding. Consequently, they agreed to amend their forfeiture request. Although the government argued that it was entitled to continue to restrain the $5 million under the substitute assets theory,[8] the court ruled against its argument and released the $5 million in assets back to Shah.[9]

The Ultimate Goal

It is clear there is no universal winner when it comes to determining the best method for tracing funds from a commingled account. When presented with the task, always keep in mind that the tracing analysis may be used in arbitration in the form of a testimony, a deposition, or an expert witness disclosure. As such, the ultimate goal is to consistently and equitably apply a tracing method that is most appropriate for the underlying facts of the case.

Jordan Sandberg, CPA, CFE, is a manager in the Phoenix office of HKA Global, LLC, a leading consultancy in risk mitigation, dispute resolution, expert witness, and litigation support. With a focus on forensic accounting, financial investigations, commercial damages, and valuations, Sandberg has assisted in multiple investigations to help government and private sector attorneys identify and trace ill-gotten gains from various fraudulent schemes. Contact him at jordansandberg@hka.com or visit www.hka.com.

[1] Cunningham v. Brown, 265 U.S. 1 (1924).

[2] United States v. Banco Cafetero Panama, 797 F. 2d 1154 (2d Cir. 1986).

[3] United States v. Henshaw, 388 F.3d 738 (10th Cir. 2004); Stoddard, William. (2002). “Tracing Principles in Revised Article 9 § 9-315(b)(2): A Matter of Careless Drafting, or an Invitation to Creative Lawyering?” Nevada Law Journal, Vol. 3, Iss. 1, Article 16.

Available at: https://scholars.law.unlv.edu/nlj/vol3/iss1/16

[4] Ibid.

[5] AICPA Code of Professional Conduct, Rule 2.100.001, “Integrity and Objectivity Rule.”

[6] Davis, Melissa. (2017, June 21). “Tracing Commingled Funds in Fraud Cases,” American Bankruptcy Institute.

Available at: www.kapilamukamal.com/wp-content/uploads/2017/07/tracing_commingled_funds_in_fraud_cases_ABI.pdf

[7] United States v. Shah, 19-cr-00864 (N.D. Ill. Feb. 3, 2022).

[8] See 21 U.S.C. § 853(g).

[9] United States v. Shah, Order on Motion to Amend, dated August 10, 2023.

This article presents the views, thoughts, or opinions only of the author and not those of any HKA entity. While we take care at the time of publication to confirm the accuracy of the information presented, the content is not intended to deal with all aspects of the subject referred to, should not be relied upon as the basis for business decisions, and does not constitute legal or professional advice of any kind. This article is protected by copyright © 2024 HKA Global, LLC.