Prolongation Claims: The Basic Principles

13th December 2023

HKA Quantum Expert Craig Enderbury sets out the basic principles of prolongation cost claims using a simple and hypothetical example. He highlights the common pitfalls of assuming time equals money and the misguided application of rates and prices from preliminaries schedule of rates / bill of quantities.

A Contractor holds an internal monthly meeting on a construction project that is in delay and over budget. Someone remarks, “Let’s get an extension of time, and then we can recover all our time-related costs”, swiftly followed with an enthusiastic reply, “Sounds like a plan. We can adopt our tender rates for preliminaries items and multiply the rates by the period of over-run”.

If this scenario sounds all too familiar, then for some, I daresay the alarm bells have already started ringing. Despite there being a wealth of information generally available on this subject, all too often prolongation claims are incorrectly calculated and submitted on the flawed basis set out above. It should therefore come as no surprise that prolongation cost claims formulated in this manner are frequently rejected by the recipient.

To avoid this common pitfall and in order to add credibility to a prolongation cost claim, the claimant should pause to consider, amongst other things, whether time does actually equal money and if so, what, and how much is claimable? With regard to the appropriate method of evaluation, is the application of tender rates for preliminaries too simplistic, or should it be based on the actual cost / loss incurred? Are there any valuation rules prescribed under the contract or is it a damages claim, e.g. actual loss and expense due to a breach of contract?

It would be impossible to provide all the answers to such hypothetical questions. Each case (or claim) will turn on the facts and has to be assessed on its individual merits, the evidence, the complexity and circumstances surrounding the events and, of course, in accordance with the contract and applicable governing law. Needless to say, in the case of a claim arising from breach of contract, the burden of proof rests with the claimant to demonstrate the cause, the effect and its entitlement. Remember that those who assert must prove!

What is a prolongation claim?

A prolongation claim can be defined as the contractual mechanism for the recovery of additional time-related costs that have been properly incurred due to compensable delay(s) to the completion of the works.

Those eagled eyed will have noticed the use of the term “compensable” delay. At this juncture it is worth taking a few moments to make the distinction between the terminology “compensable” delay as opposed to “excusable” delay and “disruption”. And of course, there is always the much debated issue of “concurrent” delays, which is touched upon later.

Different types of delay

Compensable delay

These are events that give rise to an entitlement to extension of time to the project completion date and an entitlement to recovery of prolongation costs.

Excusable delay

These are events that give rise to an entitlement to extension of time to the project completion date (and therefore relief to liquidated damages) but not necessarily an entitlement to the recovery of prolongation costs. For example neutral events, such as Force Majeure like adverse weather conditions, whereby typically the parties bear their own costs.

Disruption

There are a myriad of events that may impact on cost but do not necessarily trigger any entitlement to extension of time to the project completion date and therefore no prolongation costs. An example of such event could be the resequencing of programme activities resulting in a loss of productivity that may impact the overall cost of performing the affected activities, but does not impact on the programme critical path activities driving the project completion date.

In such instances, the cost is localised to the affected activities, not the prolongation of the project as a whole. Such events can be classified as disruption as opposed to delay.

The link between delay and prolongation claims

For the purpose of prolongation claims, the delay(s) to the completion must be the consequence of a compensable delay to the completion of the works. This includes whether it is a direct result of a site instruction, variation or change order, the occurrence of a specified Employer’s risk event or Employer’s breach e.g. an act of prevention, denied access or possession of the Site or the adverse effect to the regular progress to the Works due to the late approval of design, the late delivery of Employer documentation or free issue plant / equipment.

In short, to warrant payment of prolongation costs the delay must be compensable, affect the critical path and delay completion of the works.

Any prolongation cost claim that includes costs attributable to Contractor culpable delays, concurrent delays, the occurrence of Contractor’s risk events or neutral events (e.g. Force Majeure) is likely to be rejected in principle by the employer as the Contractor usually has no entitlement to the recovery of time-related costs under such circumstances.

Compensation for prolongation claims

With regard to compensation, the Delay and Disruption Protocol issued by the Society of Construction Law provides the following guidance:

“Compensation for prolongation should not be paid for anything other than work actually done, time actually taken up or loss and/or expense actually suffered. In other words, the compensation for prolongation caused other than by variation is based on the actual additional cost incurred by the Contractor.”

Often I see prolongation cost claims predicated on the additional time-related costs during the over-run period between the original completion date and the actual completion date. This is incorrect as it does not represent the actual loss and expense suffered at the time the project was actually delayed.

For example, an original project completion of 1 August was delayed by 4 weeks to 29 August due to an earlier 4 week critical delay that occurred in March the same year. The delay event occurred in March, not August, and therefore it is the loss suffered in March that should be quantified.

It is therefore vitally important to identify the root cause of delay, when it occurred and finished and the consequential effect the delay event had on the regular progress of the works and in turn the impact on completion of the works.

All too frequently, problems arise when parties are unable to agree when the delay(s) occurred and/or are unable to agree the extent and impact of the delay(s). Quite often an area of disagreement is the matter of concurrent delay. A useful definition of concurrent delay can be found in the case of Royal Brompton Hospital National Health Trust v Hammond, as follows:

Two or more events occurring within the same time period, each independently affecting the Completion Date.

Concurrency and prolongation cost claims

As alluded to above, concurrency will affect the Contractor’s entitlement to prolongation costs where a Contractor culpable delay runs concurrent with compensable delay. The topic of true concurrency and dominant delay has been, and undoubtedly will continue to be, the subject of much debate and case law. This is a topic in itself which is best left to the expert delay analysts to opine on and lawyers to litigate over.

Preparing a claim for prolongation costs

In layman terms, when preparing a claim for prolongation costs:

- If the culpable delay extends over a longer period than the compensable delay, the Contractor will have no entitlement to prolongation costs

- If the compensable delay extends for a longer period than the culpable delay, then the Contractor is entitled to prolongation costs for the period where the compensable delay is not concurrent with the culpable delay.

The theory is that if the Contractor’s actions, or lack thereof, is the root cause of its own losses during a period of delay, then the Contractor cannot benefit from its own failings / breach by being reimbursed losses that it has caused.

Prolongation costs: A hypothetical scenario

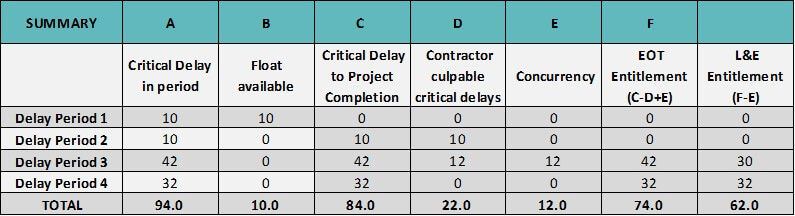

The table below summarises a hypothetical scenario. It shows the summary analysis of a contractor’s entitlement (in calendar days) to extension of time and loss and expense taking account of excusable, culpable and concurrent delays as well as float:

So, having performed a delay analysis and calculated an entitlement of 62 calendar days for loss and expense, how should a contractor approach valuing its prolongation costs?

Generally, prolongation cost claims need to reflect the actual loss / cost incurred, not a sum derived from preliminaries rates and prices contained in the contract price. A pragmatic way of calculating prolongation costs is to work out an average actual time-related costs during the delay periods.

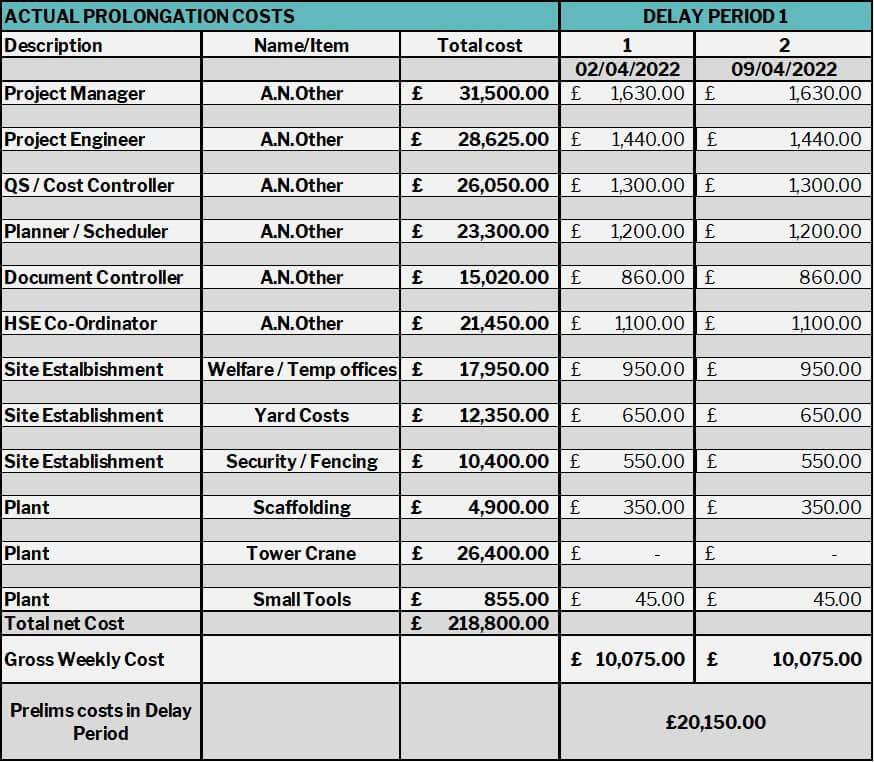

The following suggestions and examples should assist with the exercise of ascertaining the average actual time-related costs:

- Identify and review the cost pool (usually obtained by a detailed analysis of account records, cost reports, payroll, invoices etc.);

- Strip out all the direct costs (i.e. fixed costs and task / volume related costs linked to units of work) and any other one off costs / fixed charges that are not time related (e.g. mobilisation charges that would have been incurred in any event);

- Having identified the indirect time-related costs (including any unabsorbed off site / head office costs) these should be linked to the activities and project duration;

- When determining “cost” don’t be tempted to add a % profit mark-up, as profit is not a “cost” incurred by the contractor as a direct consequence of a compensable delay. Ultimately, whether or not the contractor is entitled to “cost only” or “cost + reasonable profit” will be dependent upon the terms and conditions of the contract.

- Where applicable, calculate the adjustments and/or abatements for any indirect time-related costs that have already been recovered elsewhere (e.g. under dayworks, variations or other claims). This will avoid any potential criticism of “double-dipping”;

- Demonstrate that the costs being claimed could not have been mitigated e.g. off hiring of plant /equipment, lowering of resources or redeployment of resources to unaffected activities;

- Evidence the costs have been or will be incurred – records, records, records!

Having identified when the delay occurred, a precise calculation of cost can be made for that period, for example:

The process is then repeated for the other periods, in this hypothetical example periods 2, 3 and 4.

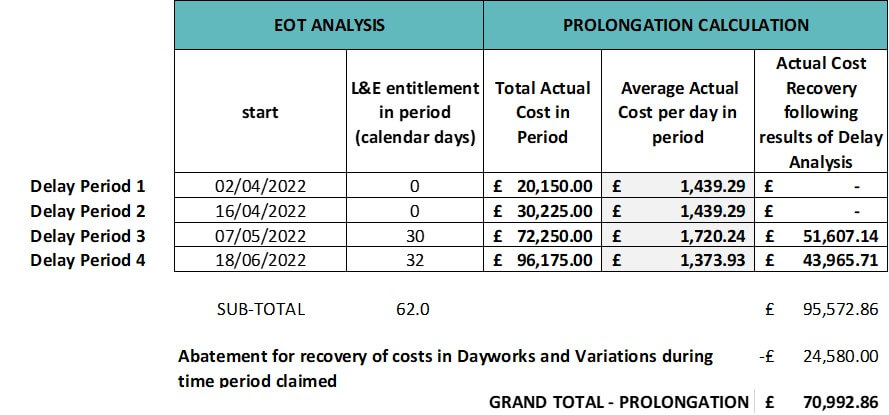

The table below shows the summation of the prolongation cost calculation by applying the average actual cost per day to the period of loss and expense entitlement, measured in calendar days.

In summary

The project completion date was delayed by 84 days, of which the Contractor is entitled to an extension of time of 74 days. Despite having established entitlement to 74 days extension of time, the Contractor is only entitled to recover prolongation costs for 62 days falling into periods 3 and 4.

The actual prolongation costs recovery is therefore £95,572.86 less an abatement of £24,580.00 for costs already recovered in dayworks and variations during the time period claimed.

In conclusion

This very simple and hypothetical example sets out the basic principles of prolongation cost claims and highlights some of the common pitfalls of assuming time equals money and the misguided application of rates and prices from preliminaries schedule of rates / bill of quantities.

RESOLVE DISPUTES WITH HKA

With more than four decades of extensive worldwide consulting expertise, HKA specialises in diverse sectors and industries. Our primary services include dispute resolution, claims consultancy, and advisory support.

On projects, we collaborate with various stakeholders including owners, operators, contractors, subcontractors, law firms and government agencies, tailoring our services to meet their individual requirements.

Contact us today to enquire about our market-leading claims and expert services.

About the author

Craig Enderbury

Principal

Expert Profile

Craig Enderbury is a qualified Quantity Surveyor with 30 years of construction industry experience as a commercial manager, quantity surveyor and contracts administrator, delivering a broad range of contracts for a varied UK and international client base spanning oil and gas, power and utilities, infrastructure, water and wastewater, MEICA, industrial and buildings sectors.

He has strong commercial and contractual knowledge having worked with a range of standard forms of contract, including NEC/ECC, FIDIC, GC Works, IChemE Green and Red Book, ICE Editions, PPP/PFI, BOT and various bespoke forms of FIDIC-based contract for international port / marine, power, oil and gas, and water/waste water projects.

He has been appointed Expert Witness and Expert Adviser on quantum matters and has extensive experience of dispute resolution, including attending DAB and arbitration hearings, the preparation of statements of claim and defence for arbitration (domestic and international), the preparation of referral notices and responses for DAB and adjudication process, the preparation of claims, counterclaims and defence submissions and resolution via negotiation.

In addition, Craig has acted as advisor and party representative / advocate in DAB proceedings.

This publication presents the views, thoughts or opinions of the author and not necessarily those of HKA. Whilst we take every care to ensure the accuracy of this information at the time of publication, the content is not intended to deal with all aspects of the subject referred to, should not be relied upon and does not constitute advice of any kind. This publication is protected by copyright © 2024 HKA Global Ltd.